The unemployment rate in the technology job market in the US is about half that of other fields — just 1.5% — so the onslaught of recent reports about major “tech worker” layoffs can be confounding.

For example, current data from online tracker company Layoff.fyi shows that 465 tech companies have fired a total of 126,057 employees in 2023 alone. And, according to layoff tracker TrueUp, so far this year, 608 tech companies have announced layoffs, affecting 162,541 people (or 2,426 people per day). In 2022, there were 1,535 layoffs at tech companies with 241,176 people let go.

While tech companies have laid off hundreds of thousands of workers over the past six months or so, the majority of those employees did not hold IT positions. And even when companies did reduce their headcount through layoffs, the number let go was typically no more than 5% to 6% of the total workforce, according to Gartner Research.

“Contrary to what we’re seeing in the headlines, many of those being impacted by layoffs are in business functions, rather than tech roles,” Gartner analyst Mbula Schoen wrote in a Q&A post this week. “Additionally, there are increasingly opportunities for IT jobs outside traditional tech companies, so it’s important to look beyond just the tech provider community to truly grasp the state of the tech talent crunch.”

In fact, Gartner found that the companies behind the 10 largest layoffs in tech talent now employ over 150,000 more people than at the beginning of 2020. When it comes to tech jobs, hiring continues to far outpace firing.

Overall, 2022 saw an increase of about 264,500 new jobs to the IT job market, according to industry consultancy Janco Associates. Those new jobs came atop the 213,000 IT jobs created in 2021.

ComTIA, a nonprofit association for the IT industry and workforce, uses employer online job posting data to predict future tech hiring. In 2023, US companies will hire 268,898 tech workers, the group predicts.

Lisa Rowan, a research vice president for IDC’s HR, Talent, and Learning Strategies Group, said that while there are some technology jobs being eliminated among the layoffs, anyone let go with IT acumen is being snapped up “quickly.”

Gartner expects current demand for tech talent to greatly outstrip supply until at least 2026, based on the research firm’s latest forecast on IT spending.

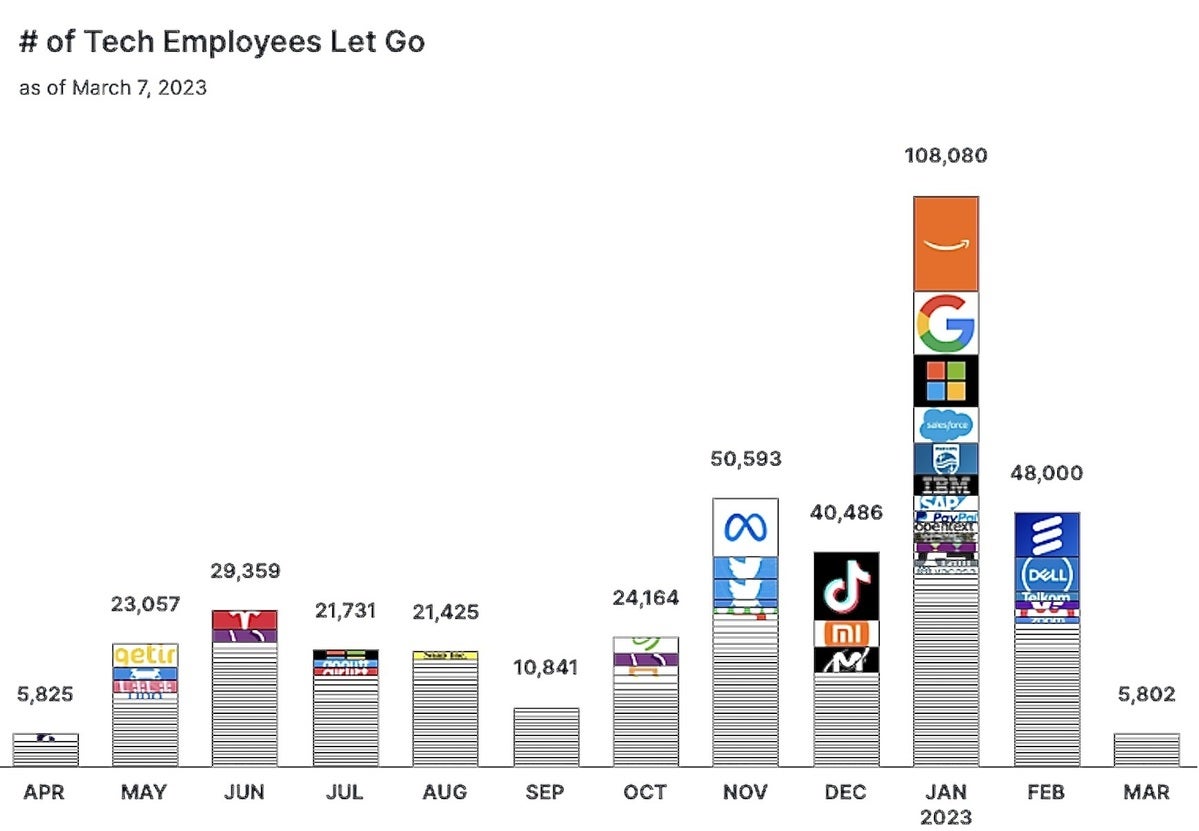

Trueup

TrueupLayoffs at tech companies (not necessarily tech workers).

Industry analysts see the current spate of layoffs as more a course correction than an indication the economy is slipping or that larger layoffs are on the horizon. Many of the force reductions have been largely driven by public companies seeking to bolster share prices and satisfy shareholders’ desire for spending cuts, according to Schoen.

For example, Amazon’s labor force doubled between 2020 and 2022, but its revenue only grew 30% in the same period.

“Faced with economic headwinds and overextended labor costs from rapid expansion over the past couple of years, many tech companies are now seeing the need to rein in operational costs,” Fiona Mark, a principal analyst with Forrester Research, said in a blog post.

And, while the layoffs have been described as an adjustment after over-optimistic hiring, data shows that new hires were not necessarily impacted, Gartner’s Schoen said. “Instead, recent layoffs affected a broader range of employees and initiatives as organizations prioritize key products and services to position their company for specific market opportunities,” she said.

A post-COVID ripple effect

During the COVID-19 pandemic, organizations scrambled to move to online sales and services; digitization projects exploded and led to panic hiring by many organizations. All the while, retiring Baby Boomers left industries scrambling to fill roles.

Many of the jobs related to the hiring spree were in human resources, recruiting, marketing, and sales. And, inevitably, as the overall available pool of workers dwindled, contractors were tapped for specific work. Now, those workers are the ones suffering the greatest impact from layoffs, according to Gartner.

Contractors are typically the first to go, according to Lily Mok, a Gartner research vice president. “Then they [companies] go to the employee pool for less critical areas or those workers who are lower risk for inability to rehire back.”

Not all tech companies are approaching layoffs the same way, according to Forrester’s Mark. Some organizations, such as Amazon, are focusing on products that are not generating the revenue that they anticipated, such as the Alexa device line. Others are making cuts across multiple departments.

“However, when we dig into the data captured on Layoffs.fyi, reduction in engineering roles comes out behind roles in teams such as human resources, marketing, and operations,” Mark said. “Tech companies still value engineering and tech talent as a way to create differentiation and growth. Tech leaders should be aware, though, that layoffs in other departments, such as recruiting, will have an impact on their ability to staff teams.”

IT positions have rarely been on the chopping block. Impacted by digitization technology needs and a dearth of available tech talent due to the Great Resignation, tech workers are in demand now like never before, and companies continue to buy tech in a big way.

In 2023, enterprise spending on software and IT services is projected to increase 9.3% and 5.5%, respectively. Worldwide, that’s $4.5 trillion being pumped into technology, up 2.4% from 2022, according to Gartner.

According to a recent LinkedIn report, of the top 10 hard skills most in demand by organizations, IT positions were at the top, and tech positions also accounted for most of the top 10 slots.

Workers with software development skills, which companies need to build the products on which consumers and businesses depend, are most in demand, according to LinkedIn. Data management skills are also prominent. Skills such as SQL (No. 2 on the LinkedIn list) help companies manage and make sense of data across the business, remain in high demand.

“I don’t see any jobs being cut in security, cybersecurity, and or analytics job roles — they have a fairly significant shortage of talent,” Mok said. “It’s very competitive for IT jobs.”

Demand for IT skills outstrips demand

For example, in North America, the demand-to-supply ratio for cybersecurity and data scientist talent is 0.4, according to Gartner. In other words, there is less than one candidate available for every cybersecurity and data scientist job posting.

CIOs, hiring managers, and recruiters are under unprecedented pressure to find tech talent. In a Gartner survey conducted in November and December 2022, 86% of CIOs reported facing more competition for qualified candidates, and 73% were worried about IT talent attrition.

Staffing and retention are now a primary priority of C-Level management, according to Janco Associates.

Gartner’s Schoen agreed, saying CIOs must be more intentional in applying proven practices that help them effectively attract top talent and quickly fill open positions. “For example, CIOs should cast their nets wide to tap into a large pool of passive IT candidates,” she said. “Many IT hiring plans are designed to target active job seekers rather than passive ones, leaving an untapped opportunity to increase the quality and quantity of IT candidates.

“CIOs should consider ramping up employee referral programs, or use talent intelligence capabilities that leverage artificial intelligence to source passive candidates from social search,” Schoen said.

CIOs can also target laid-off workers in adjacent tech categories and training them to build needed IT skills. For instance, Schoen said, it’s hard to find data scientists, but there is a significant number of data and business analysts available who could be trained on more technical skills.

“CIOs should work with recruiting functions to adjust job posting requirements to include adjacent skills that are desirable for open roles,” Schoen said.

IT talent retention has also been affected by the uptick in layoffs, even if those being fired aren’t working in IT. Corporate downsizing spurs IT workers to leave companies that they see as less stable, according to Mok. “Downsizing always has negative connotations, no matter how large or small.”

Tech salaries are still rising

The tech talent shortage is also lifting IT salaries, according to Janco Associates. On average, IT salaries rose by 5.61% in 2022 and are expected to increase by as much as 8%, on average, this year, according to a recent report from Janco. The mean compensation for all IT pros in 2023 is $101,323; for IT pros in large enterprises it tops $102,000; and for executives it averages $180,000.

Organizations that revamp their employee value propositions for tech talent will be better positioned for focused and efficient growth, according to Schoen.

“Companies that do not live up to employees’ expectations may find that even if they are able to get candidates in the door, those candidates leave as soon as a better offer comes along,” Schoen said. “Focusing on factors other than compensation that employees care about, such as flexibility and growth opportunity, can improve the IT organization’s EVP to win current and future competition for talent.”

Companies considering layoffs should also be forewarned, according to Mok and others.

“You need to think about the availability of talent when you may need to rehire people back. Even if you need to cut them, it’ll be even longer to hire them back. So, it’s very high risk to let go any in-demand job roles,” Mok said. “The number one criteria for downsizing should be to ask yourself, ‘Can we live without these roles and still execute our future strategy over the next 12 to 18 months?’”

Copyright © 2023 IDG Communications, Inc.