Vertiv is emerging as a major beneficiary of thermal management solutions for data centers.

Artificial intelligence (AI) has undoubtedly played a big role in fueling positive market sentiment over the last two years. At the same time, investors should be aware that not all AI opportunities have the same potential. One pocket of the AI landscape that I think is particularly lucrative for long-term investors is data center services.

Data is increasingly becoming more important for business leaders to make more informed decisions. Moreover, generative AI applications for autonomous driving, large language models, and machine learning all rely on vast loads of data. While Nvidia has emerged as a darling in the data center arena, savvy investors know that other opportunities are out there.

Let’s dig into why I see Vertiv Holdings (VRT -2.89%) as a compelling opportunity in the data center space and think right now is as good a time as ever to scoop up some shares.

What does Vertiv do?

Vertiv provides digital infrastructure solutions for data centers, communications networks, and commercial and industrial environments. Approximately two-thirds of the company’s sales are derived from power management and thermal management products such as switchboards and chilling solutions.

Image source: Vertiv Investor Relations.

Why Vertiv is emerging as a data center leader

Have you ever been working on a laptop only to have the computer begin to glitch and suddenly give off some heat? Understanding why this might happen draws parallels to how data centers work. More importantly, it will help paint a picture as to why Vertiv is ideally positioned in the data center market right now.

At their core, data centers are simply enormous buildings that house rows of server racks. These racks contain a number of IT infrastructure products, namely high-performance semiconductor chips. These chips, dubbed graphics processing units (GPUs), are constantly processing tons of information. As a result, server racks can experience intense heat.

This can be a major risk to data centers, and companies like Vertiv are working to combat this issue. Namely, thermal management solutions can help cool down server racks and dissipate overheating in data centers.

According to Mordor Intelligence, the data center cooling market is currently worth $16.6 billion. However, research suggests that the data center cooling market will expand at a compound annual growth rate of 16% through 2029 — making the addressable market worth $34.5 billion by the end of the decade.

Image source: Getty Images.

A premium valuation well worth the price

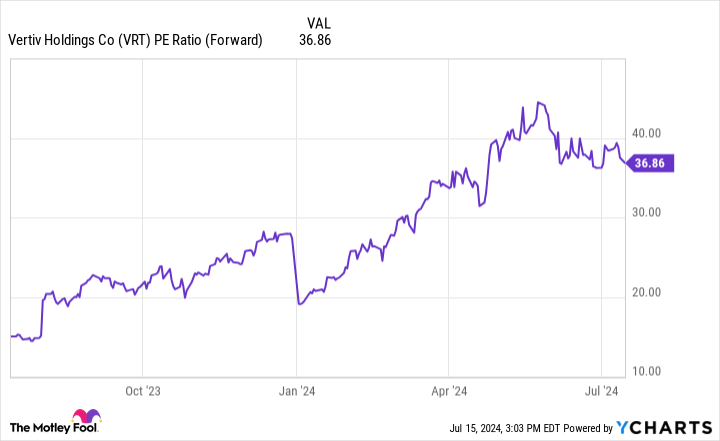

The chart below shows Vertiv’s forward price-to-earnings (P/E) ratio of 36.9. While this is well above the S&P 500‘s forward P/E of 22, I think the premium is warranted. While Vertiv stock is by no means a bargain, I see it as both an especially good and possibly misunderstood opportunity. And this year, I think the stock has enjoyed some momentum thanks to broader positive sentiment in the technology space, and AI businesses in particular.

VRT PE Ratio (Forward) data by YCharts

As I alluded to earlier, each opportunity in AI is different, and the same notion can be applied to subsets of the broader AI landscape. In general, the market for data centers should continue to witness outsize growth as data becomes ever more important for developing breakthrough AI applications.

However, the rising need for data should also lead to more demand for cooling and thermal management solutions. Investors who are looking for under-the-radar opportunities in AI — and particularly data center services — may want to consider a position in Vertiv.

As AI becomes increasingly more utilized across different end markets and use cases, the demand trends for thermal management solutions explored above could actually be conservative. All of this should ultimately benefit Vertiv for years to come.