European markets back in the red

So much for turnaround Tuesday!

After a positive start, European stock markets have fallen into the red again.

The feeling of optimism following the sharp rally in Tokyo overnight has not lasted for long.

In London, the UK’s FTSE 100 share index is down 35 points, or 0.45%, at 7972 points – so still higher than its low point yesterday.

Germany’s DAX has lost all its earlier gains, now down 0.3%, while France’s CAC has lost another 0.6%.

Reminder, that follows a strong recovery in Asia after Monday’s rout, with Japan’s Nikkei surging around 10% – its biggest one-day jump since the financial crisis of 2008.

Key events

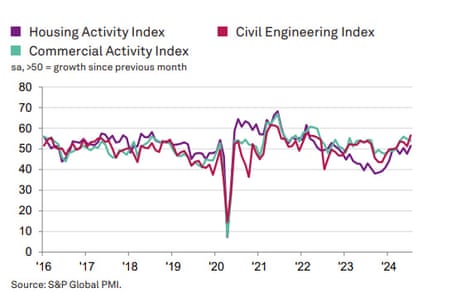

The outlook for the UK construction sector looks to be quietly optimistic, flags Emma Fildes of Brickweaver, after July’s pick-up.

Civil engineering followed by housing and commercial activity forged ahead in July 24 as customers’ confidence returned boosting new orders which in turn caused more firms to expand their workforce. Generally, within the industry, the 12mth outlook is quietly optimistic @SPGlobal pic.twitter.com/md2NawGNTE

— Emma Fildes (@emmafildes) August 6, 2024

A shortage of building workers could undermine the UK construction sector’s recovery, warns Kelly Boorman, national head of construction at RSM UK:

There has been some volatility in the market, due to a lack of access to affordable funding, the impact of wet weather and ongoing labour shortages. With the availability of subcontractors falling in July, there is likely to be a tightening of labour and the supply chain due to increased activity, so there are some concerns over whether housing targets are achievable.

“To avoid housebuilding targets from becoming pie in the sky, construction needs more clarity on where labour and funding is coming from to realise housing volumes, especially businesses with plans for growth and ability to manage working capital.”

The pound is weakening on the foreign exchanges too.

Sterling has dropped by three-quarters of a cent this morning against the dollar, touching $1.27 for the first time since early July.

European markets back in the red

So much for turnaround Tuesday!

After a positive start, European stock markets have fallen into the red again.

The feeling of optimism following the sharp rally in Tokyo overnight has not lasted for long.

In London, the UK’s FTSE 100 share index is down 35 points, or 0.45%, at 7972 points – so still higher than its low point yesterday.

Germany’s DAX has lost all its earlier gains, now down 0.3%, while France’s CAC has lost another 0.6%.

Reminder, that follows a strong recovery in Asia after Monday’s rout, with Japan’s Nikkei surging around 10% – its biggest one-day jump since the financial crisis of 2008.

Eurozone retail sales fall

In less encouraging news, eurozone retail sales have fallen again.

Reail sales in the euro area dropped by 0.3% in June, new data shows, missing forecasts for a 0.2% rise.

Analysts at ING say this is “more sluggish news about the eurozone economy” as consumers postponed the retail recovery again.

Can Labour take some credit for the jump in building work last month?

Bloomberg says UK construction activity last month was boosted by “the culmination of the election that brought to power a Labour government promising to spur building”.

The pick-up in construction sector activity last month should help the sector drive UK economic growth, reckons Max Jones, director of infrastructure and construction at Lloyds Bank:

“A fifth consecutive month of growth is what contractors would have hoped for, as we move further into the second half of the year. Many contractors we speak to have been feeling upbeat and have confidence to invest in priority areas such as growth, technology, and sustainability.

“Firms will hope this investment translates into helping bolster pipelines of new work. If successful, these efforts will see the construction industry become a more important partner towards driving future growth.”

UK construction activity increases at fastest pace in 26 months

Newsflash: growth accelerated in the UK construction sector last month, at the fastest pace in 26 months.

Building firms reported “much faster increases” in both activity and new orders in July, according to the latest poll of purchasing managers by S&P Global.

Thsi lifted the Construction Purchasing Managers’ Index up to 55.3 in July from 52.2 in June, showing faster growth (50 points = stagnation).

That’s the fastest rate of expansion since May 2022.

S&P Global reports that all three categories of construction grew last month – civil engineering expanded fastest, followed by commercial work and then housebuilding.

A pick-up in housebuilding should be welcome news for the new government, as it aims to build 1.5m new homes this parliament.

Andrew Harker, economics director at S&P Global Market Intelligence, says:

“The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July. Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence.

The strength of demand moved the sector closer to capacity, bringing a recent period of improving supplier performance to an end. There were also signs of inflationary pressures picking up, something that will need to be watched closely if demand strength continues in the months ahead.”

While market moves in recent days have been dramatic, it is important to keep them in the context of recent “exceptional performance” for global equities.

So says Mark Haefele, chief investment officer at UBS Global Wealth Management.

He recommends investors focus on ‘quality’ shares and bonds, which should be in demand if recession fears rose:

“We think volatility is likely to remain high in the near term, and that the Fed is likely to cut interest rates more quickly.

But we believe recession fears are overdone, and that investors should focus on deploying cash in quality fixed income, tilting equity allocations toward “quality” stocks, and diversifying portfolios across asset classes, including with gold and the Swiss franc.

The latest future prices show Wall Street is set to open higher:

Reuters reports:

This is why traders are often keen to ‘buy the dip’:

Since 1980, an investor buying the S&P 500 index 5% below its recent high would have generated a median return of 6% over the subsequent 3 months,

enjoying a positive return in 84% of episodes pic.twitter.com/Q4AL5dGazX

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) August 6, 2024

Here’s Richard Hunter of Interactive Investor on this morning’s market moves in London:

After a decline of 2% yesterday, the FTSE 100 nudged ahead in early trade, with some of the largest fallers recouping part of their losses, most notably Melrose Industries, Pershing Square and Scottish Mortgage. Well received numbers from InterContinental Hotels provided another boost, while the very nature of the index, being awash with stable and established companies, may well have attracted some overseas buying interest by way of defensive positioning. Having recovered some of its poise, the premier index remains ahead by 4% so far this year, although the end to the volatile state of global markets cannot be called just yet.

The FTSE250 opened at a briskly positive pace, retracing some of Monday’s losses, to leave the index up by 3.8% in the year to date. The index also has a number of defensive plays within its constituents which, coupled with a lower risk of recession in the domestic economy than elsewhere, could also be attracting some investors in search of a relatively sheltered investment destination.”

Germany’s DAX index is leading the rest of the region higher this morning, up around 0.8%.

Energy stocks, industrial companies, utilities and tech firms are leading the risers in Berlin.

A US recession appears “inevitable” by the end of the year unless the US Federal Reserve cuts interest rates, fears Steven Blitz of TS Lombard.

However, he’s also confident that the Fed will indeed act, telling clients:

The search is on for indications that the economy is heading towards recession if the Fed fails to act sooner than later – not for indicators of recession itself.

The softening data that are rolling in are not capital crimes against growth but are problematic because a U-turn in direction is difficult when the funds rate is 100BP above the prescribed Taylor Rule and 250BP > inflation (neutral real rate is presumed to be 80BP to 120BP).

Money is expensive and a rallying 10Y [ten-year US govenment bond] is not enough to ease financial market conditions. The adage that business cycles are murdered by the Fed appears on track, yet again.

Britain’s stock market has opened higher too, but – again – it’s a somewhat subdued start.

The FTSE 100 index is up 32 points, or 0.4%, at 8040 points, which only makes a small dent in yesterday’s 166 point (2%) slide.

Engineering firm Melrose (+3.5%) are the top riser, followed by Intercontinental Hotels which beat earnings forecasts this morning.

But Rightmove is dragging the index down – off 5.7%. It told investors this morning that its contract with the UK’s largest lettings platform OpenRent will terminate at the end of this month, but reiterated its sales and profit guidance.