Also in the letter:

■ Titan Capital’s Rs 200-crore fund

■ RBI crackdown on P2P lenders

■ Q-commerce grows with bigger packs

Ola Electric shares surge post-debut; market cap at $7 billion

Shares of Bhavish Aggarwal-led Ola Electric rose over 4% during Wednesday’s session on the BSE to touch Rs 143.8.

Up & up: Ola Electric shares were up 4.4% on Wednesday after the company received certification for production-linked incentive (PLI) benefits for two more of its vehicles.

The 3 KwH (kilowatt hour) and 4 KwH versions of Ola S1X have received the certification for compliance with the eligibility requirement for the PLI scheme after having “successfully met the stringent minimum localisation criteria of 50%” mandated by the government.

“These two products make almost 50% of our orders. More wind in our sails as we build India’s EV future!” Aggarwal said in a post on X.

Valuation jump: The stock has now surged 90% since its flat debut on August 9, with the electric scooter maker’s valuation hitting $7 billion.

ET had reported on July 17 that Ola Electric launched its initial public offering (IPO) at a significantly lower valuation after facing investor pushback amid concerns over its profitability. Aggarwal had told us in an interview that the issue was priced so as to ensure it was attractive to a wider set of investors.

However, this jump has helped the founder achieve his target valuation much sooner than expected, buoyed by strong investor demand in the country’s hot IPO market.

New-age pop: Ola listed alongside new-age peers FirstCry and Unicommerce which debuted at a strong premium. This came on the back of a rally in India’s other technology companies. Shares of food delivery firm Zomato and insurance marketplace operator PB Fintech have more than doubled this year.

Growth of ecommerce in India ‘matter of concern’: Piyush Goyal

Union Commerce Minister Piyush Goyal on Wednesday expressed concerns over the rapid expansion of ecommerce firms in India, describing it as a “matter of concern” rather than an achievement.

Quote, unquote: “Are we going to cause huge, social disruption with this massive growth of ecommerce? I don’t see it as a matter of pride that half our market may become part of the ecommerce network 10 years from now; it is a matter of concern,” Goyal said at an event for the launch of a report on the ‘Net Impact of E-Commerce on Employment and Consumer Welfare in India’.

Impact: With ecommerce experiencing a growth rate of 27% per year, the Union minister expressed concern about the potential disruptions for the 100 million small retailers across the country. He also raised concerns about the pricing strategies used by some ecommerce firms. “Is predatory pricing policy good for the country?” he queried.

Also Read | Amazon pumps Rs 1,660 crore into India marketplace entity

Amazon’s investment: Goyal questioned the enthusiasm surrounding Amazon’s announcement of a billion-dollar investment in India, suggesting that a closer examination of the implications is necessary.

Read our in-depth coverage on the rise of quick commerce:

Titan Capital closes Rs 200-crore fund to double down on existing portfolio startups

Kunal Bahl (Left) and Rohit Bansal

Seed-stage investor Titan Capital, founded by Snapdeal cofounders Kunal Bahl and Rohit Bansal, has raised Rs 200 crore for its new fund.

Details: Bahl and Bansal are the largest limited partners (LPs), or sponsors, of the Titan Capital Winners Fund.

- Through this fund, the firm will focus on its existing portfolio companies.

- This is the first time Titan Capital has seen participation from outside investors, including prominent family offices and chief executives.

- A few LPs are expected to be added through an optional greenshoe.

Verbatim: “With the Titan Capital Winners Fund, we can more significantly support the founders of our portfolio companies in subsequent rounds of capital raises, further strengthening Titan Capital’s partnership with them,” Bahl and Bansal said in a joint statement.

Background: Since 2011, the two investors have backed more than 250 companies. Their seed investment portfolio includes startups like Urban Company, Mamaearth, OfBusiness, Razorpay, Unicommerce and Ola Cabs. The fund made a complete exit from Urban Company in July, bagging a nearly 200 times return on their nine-year-old seed investment.

Bahl and Bansal are also promoters of ecommerce enterprise software developer Unicommerce, which listed on the bourses on August 13 at a hefty premium.

Also Read | Chiratae Ventures unveils third cohort of seed investment programme

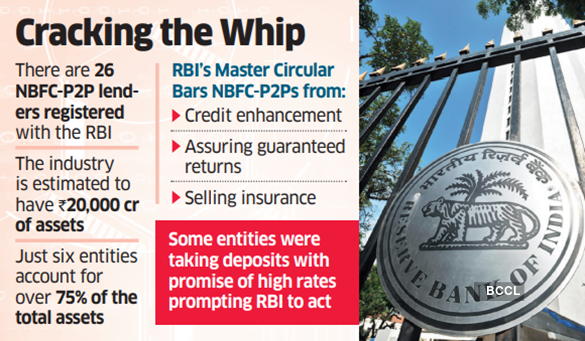

P2P platforms taking on the lender role led RBI to read the riot act

Several peer-to-peer (P2P) lenders were found to have hundreds of crores of rupees in escrow accounts, in violation of guidelines laid down by the Reserve Bank of India (RBI), sources said, adding that this led to a tightening of norms by the central bank.

Driving the news: Many lenders were interpreting the regulations liberally to suit their lending practices, forcing the regulator to come up with norms that clearly state that they can’t assume the role of lending institutions, people in the know said.

The revised master circular on regulations for P2P lenders includes barring them from credit enhancement, assuring guaranteed returns, and prohibiting them from selling insurance products.

Also Read | P2P companies go easy on partnership business as RBI sounds alert

Pushback: The Association of P2P Lending Platforms told us that the guidelines will take the sector back by at least five to seven years, with some of the features not being financially feasible for implementation.

Also Read | P2P companies balk at RBI’s new rules, fear business disruption

Quick commerce companies increase weight as consumers opt for larger packs

Quick commerce firms are increasing the total weight of deliveries per order as consumers have started doing monthly large-pack shopping from the 1st to 10th of every month, replacing modern retail stores and other ecommerce platforms.

Bulking up: Industry executives have noted that the delivery weight limit, which was previously up to 15 kg, is now being increased by key players to 35 kg or more. Swiggy Instamart has started up to 35 kg delivery on a bike in certain pin codes and Blinkit too has expanded the weight limit.

Also Read | Flipkart explored a deal with Swiggy for a pie of quick commerce

Market share: Quick commerce has rapidly become the fastest-growing channel for FMCG companies, with consumers in major cities preferring it for its convenience, faster and scheduled deliveries, and better discounts. For most FMCG companies, the channel is already 30-40% of their total ecommerce sales.

Also Read | ETtech In-depth: Quick commerce is diversifying fast. It won’t be easy

Today’s ETtech Top 5 newsletter was curated by Riya Roy Chowdhury and Vaibhavi Khanwalkar in Bengaluru.