Snapchat has published its latest performance update, which shows that it’s ad business is steadily improving, though its user growth is showing more solid signs of stagnation, and a potential cap on its usage.

We’ll start with that element first. Snapchat added 11 million users in Q3, taking it up to 443 million daily actives.

Which is a steady increase, though as you can see in these charts, there are some concerning factors within Snap’s growth.

The biggest issue for investors will be that North American DAU’s remained flat at 100 million, where they’ve been sitting now for more than two years. That’s still a significant user base, in a major market, and the fact that Snap has maintained it is a positive. But the stagnation here highlights Snap’s ongoing growth challenges, particularly in relation to people “aging out” of Snap’s market. As that happens, the app has seemingly been able to replace these users. But the bottom line is that it’s not growing its market share in its most established market.

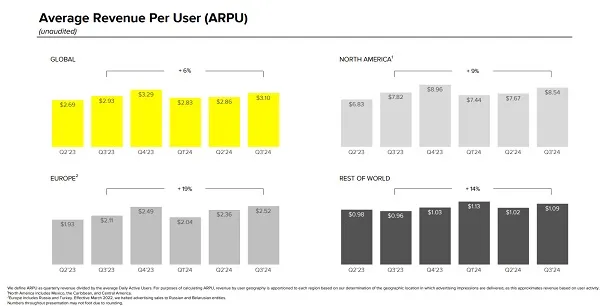

Which doesn’t bode well for expanded opportunities, and when you look at its regional revenue per user stats, it also points to an ongoing concern.

Snap still generates the majority of its revenue from its U.S. users, so it really wants to see more growth there. Which hasn’t happened for some time, while its DAU growth in Europe has also been minimal over the past year.

From an investor standpoint, this could be viewed as a potential plateau, that Snap, in the markets where it’s been around the longest, has now hit a clear cap on its growth potential. Older users switch off, younger users come in, but Snap is seemingly at its limit, based on the last year of data at least.

That, of course, is not definitive, and Snap may still find new ways to attract new users. But it does seem like we’re starting to see the scope of Snapchat’s potential reach coming into view, with growth still coming in the “Rest of World” category, but that too could reach a similar limit.

That’ll no doubt spook the market, as it also puts a clear limitation on Snap’s ad business growth.

Snap is trying to address this, by reformatting the app with a more simplified, streamlined UI, in order to make it more welcoming to new users.

And thus far, Snap says that the revised UI is doing well among those who have access:

“Broadly speaking, “Simple Snapchat” is driving the greatest content engagement gains among more casual users, which is an important input to community growth and advertising inventory. We are seeing particularly positive impacts on Android devices, including increased time spent with content, increased story views, and more replies to friends’ stories. We’re also seeing an increase in content active days on iOS, but the impacts to other top engagement metrics are not yet as broadly positive as on Android due in part to the differences in engagement across these platforms.”

So the updated format is seemingly helping to drive more adoption among new and casual users, which is a positive trend. But even so, Snap remains hesitant on a full roll-out of the update:

“While we believe growth in content engagement and demand for the new ad placements may build over time, many of the changes associated with Simple Snapchat occur immediately as Snapchatters transition to the new user experience, which presents the risk of near term disruption. While we do not currently anticipate a broad roll-out of Simple Snapchat in our most highly monetized markets until Q1 at the earliest, we have now begun limited testing in these markets and may further expand this testing as we move through Q4.”

In other words, while the longer-term engagement results look positive, the immediate response from users could see more of its U.S. and EU users switching off as a result, and Snap’s not ready to risk that on a broader scale as yet.

But maybe, eventually, that’ll present another way for Snap to remove the cap on its usage growth.

In terms of revenue, Snap brought in $1.37 billion in Q3, a 15% increase year-over-year.

Snap says that its direct response products are seeing positive advertiser response, while it also continues to attract more SMB advertisers to the app.

Snap’s also experimenting with new ad formats, including “Sponsored Snaps”, which will see ads inserted into user inboxes in the app for the first time. Which I don’t think is going to be overly well-received, but again, with its usage growth seemingly limited, it has to do something to expand its revenue opportunities.

That’s where the real squeeze comes in, with Snap being forced to find more and more ad opportunities, wherever it can, while also not alienating the audience that it has by pushing too many promotions.

Again, a cap on growth in its key markets is a concerning factor.

In terms of usage trends, Snap says that total time spent watching content in the app has increased 25% year-over-year, while “Spotlight”, its TikTok-like short-form video feed, had more than 500 million monthly active users, on average, in Q3.

Snapchat+ also continues to grow, with 12 million users now paying a monthly fee for various add-ons in the app. Snapchat reported that it had reached 11 million paying users back in August, so it’s added an extra million subscribers in just two months.

In comparison to other subscription offerings from social apps, Snapchat+ has been a big success, with X struggling to reach even 1.3 million X Premium sign-ups, despite both offerings being launched at around the same time. As always, Snap has shown that it knows its audience, and what they want from the app, which has enabled it to provide more options to entice Snapchat+ sign-ups.

It remains a minor element in terms of revenue (Snapchat generated more than 90% of its revenue from ads in the period), but it’s another indicator of Snap’s enduring popularity among its dedicated users, and the stickiness of the app for teens, in particular.

Another area of concern for Snap, however, could be its capacity to continue to invest in larger-scale projects like its AR glasses, if its growth is indeed limited.

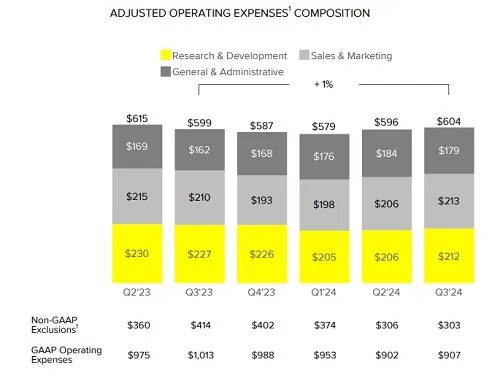

Because looking at Snap’s costs, its “Research and Development” charges are starting to rise once again.

Snap says that a ramp in ML and AI investments are inching this higher, after Snap had kept things relatively in check on this front, and Snap will also need to invest a lot more before its AR Spectacles reach consumers in a few years time.

Without that investment, the whole project will fall flat, so Snap will need shareholder faith to take that jump. Yet, with Meta also putting its AR glasses on a similar timeline, it also seems likely that Snap is going to struggle to gain adoption for its AR device either way, because as per our review of Snap’s AR device versus Meta’s Orion glasses, Meta’s AR glasses, in their current form, are superior to Snap’s, in almost every way.

I’m not sure I see a future in that project, especially given these numbers, because Snap simply doesn’t have the resources to compete, and is likely to be blown out of the water by Meta’s device upon launch either way.

Though it is interesting to also note that Snap has initiated a $500 million share buyback program as part of its results announcement. That might reduce the pool of potential objectors to its AR plan.

Snap still has opportunities in international markets, and its improving and expanding ad options are delivering results. But as noted, I would be concerned about its stagnating growth, and what that may mean in terms of a potential saturation point for the app.

Because once you reach that wall, then your only remaining growth lever is, essentially, more ads.

And with an ever-changing core base of younger users churning through, that’ll push Snap closer to losing its audience.

You can check out Snap’s full Q3 2024 results here.