It was at a November 2012 meeting at the University Club on Fifth Avenue that

But a decade later, Centerview founders

The records dispute, which goes on trial Tuesday in Delaware Chancery Court, could end up opening the books on an elite firm that has worked on deals worth $3 trillion since its 2006 launch. Centerview, which advised

“That would be of huge interest,” said Steven Eckhaus, a lawyer who specializes in compensation. “People on Wall Street look to companies like Centerview to determine how much they should be making.”

The case could also shine a light on one of the most prestigious but ill-defined titles on Wall Street: partner.

Centerview in a statement called Handler’s claims “baseless.” Handler declined to comment on the case.

Handler and Pruzan are expected to testify at Tuesday’s hearing, which will take place at the Court of Chancery in Georgetown. Both men have already given depositions in the matter. On Wednesday, Handler’s legal team, led by Michael Bowe of Brown Rudnick LLP, will face off against Centerview’s lawyers, led by Michael Carlinsky of Quinn Emmanuel Urquhart & Sullivan LLP.

The agreement Handler alleges was reached at the University Club was never put in writing, and Centerview has said in court filings that subsequent emails show that there never a final deal. The firm says other documents show Handler held equity only in a secondary corporate structure, not in the overall company.

But the documents cited by Centerview aren’t exactly clearcut. At a hearing in the case last November, Delaware Chancery Court Judge Samuel Glasscock raised that issue with the founders’ lawyers. “I assume that there’s a list of equity-holders, partners, and Mr. Handler is or isn’t on it, right?” the judge asked.

Centerview lawyers said there was but later backtracked and said the bank’s “primary method” for tracking its equity-holders was its issuance of K-1 forms for top staffers to report their compensation to the Internal Revenue Service. But they also said that K-1s didn’t signify partnership, as Effron and Pruzan were the only true partners at Centerview.

Handler, who never received K-1s, is asking the court to give him those forms for Effron, Pruzan and two other Centerview bankers as part of his records request.

There is a 2013 limited partnership agreement that Handler didn’t sign, but he contends Centerview is inflating its importance. He notes that the company had not treated it like the foundational document Effron and Pruzan claim that it is. In deposition questioning, Pruzan acknowledged that the document had been “thrown in a drawer and never taken out.”

Handler also argues that the circumstances surrounding the University Club meeting show Effron and Pruzan intended to make him a senior partner with equity. Recruited from UBS in 2008, Handler was tasked with building a technology group for Centerview. According to him, his team proved so successful, with a roster of clients led by Motorola Inc., that Effron and Pruzan began looking for ways to restructure his compensation, which was mostly a business-origination percentage at the time.

The founders happily agreed that his annual pay would be lowered in exchange for a stake in Centerview, Handler claims. “We hugged at the end of the meeting,” he said in a deposition.

Hugging definitely seems off the table now. In court filings, Handler has accused Effron and Pruzan of misleading most Centerview bankers about the “profit pool” from which they are paid and making secret adjustments for their own benefit. He raised that argument in pushing back against Centerview’s request to seal many of the Delaware court filings as proprietary company information.

“A fraudulent ruse on your employees and partners is not ‘proprietary,’” Handler’s lawyers said, “and maintaining that ruse is not a bona fide commercial purpose for redaction.”

Centerview denied the allegation in a statement. “Centerview’s partners have full transparency into the firm’s performance and compensation practices,” the firm said. “Any suggestion to the contrary is patently false.”

Handler has also said in court filings that he was pushed out of Centerview as retaliation for complaining to Effron in 2020 and 2021 that Pruzan had created a hostile work environment for bank employees. Centerview, which denies the claim, has called Handler a disgruntled employee who plotted to launch a rival firm.

Even if the court decides he is a partner, Centerview said the issue is moot because departing partners are required to sell back their stake to the firm for a nominal price.

Glasscock could rule quickly on whether to grant Handler access to Centerview’s records after the end of arguments on Wednesday. Though giving them to Handler won’t make them publicly available, such records are typically sought as ammunition for further litigation.

Read More:

A lengthy dispute could be embarrassing for Centerview and its founders. The firm has emerged as an M&A powerhouse since its launch — it ranked fifth in Bloomberg’s league table of mergers and acquisitions advisers for the first half of 2023, beating

In addition to the Credit Suisse deal, Centerview’s been advising

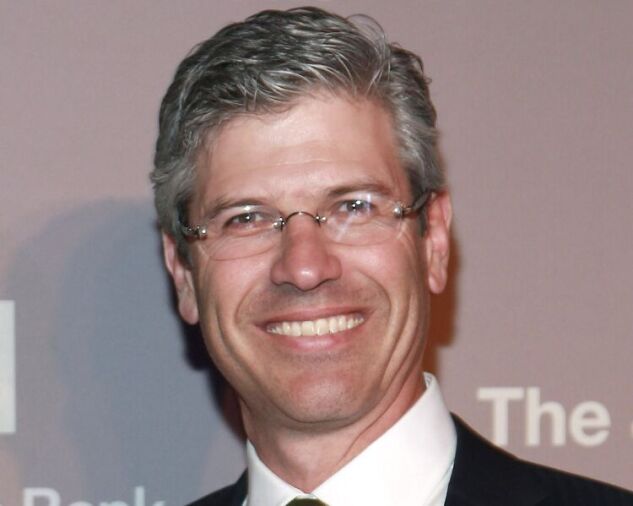

Effron began his Wall Street career at Dillon, Read & Co. and eventually became vice chairman at UBS, which took over the US bank in 1998. He has become a significant player in political and cultural circles. A major donor to the Democratic Party, he’s a member of President

Pruzan, who keeps a lower profile, started off as a

(updates with details of hearing and law firms in graph seven)

To contact the reporter on this story:

To contact the editors responsible for this story:

Anthony Lin

© 2023 Bloomberg L.P. All rights reserved. Used with permission.