Also in this letter:

■ Paytm eyes profitability

■ NCLAT adjourns Byju’s hearing

■ Mamaearth shares tumble

Big bettors toss tough questions at WazirX amid legal tangles

Two of the largest corporate users of the WazirX platform are throwing tricky questions at the cryptocurrency platform, which has knocked on the doors of the Singapore insolvency court after a crippling crypto heist.

Tell me more: The duo has, in a letter to the Singapore court, questioned why they are described as contingent creditors of a Singapore company (named Zettai) in the court papers when their dealings have been with WazirX, which is owned by an Indian entity Zanmai.

Most investors in India were unaware that Zettai is the parent of Zanmai, which launched the WazirX platform.

Also Read | Crypto’s legal tangles seem as mystifying as digital asset itself

The two investors — Bitcipher Labs (which owns CoinSwitch, another crypto platform) and NextGenDev — have asserted that their “legal relationships are with Zanmai and not Zettai.”

Cyber heist: A cyberattack in July 2024 saw one of the platform’s wallets emptied of $234 million in funds. But it is unclear which specific wallet was emptied and which of WazirX’s users’ funds were held in that wallet, said the two platform users.

Also Read | Hacker behind $234 million India crypto theft starts washing funds

Context: According to the affidavit filed by WazirX founder Nischal Shetty, Zettai took control, “under protest”, of the cryptocurrency tokens from its partner Binance (the world’s largest crypto exchange) following a rift between the two. The dispute is currently amid arbitration proceedings, whose deliberations are confidential, in Singapore.

FIU hearing: Separately, anti-money laundering body Financial Intelligence Unit (FIU) will this week take up the petitions of seven offshore virtual digital assets service providers – Bitfinex, MEXC Global, Kraken, Huobi, Gate.io, Bittrex and Bitstamp – to restart their operations in the country.

These exchanges were banned for non-compliance with India’s Prevention of Money Laundering Act (PMLA).

Also Read | WazirX parent looking for ‘white knights’ to rescue crypto exchange

NPCI posts 37% jump in FY24 net profit to Rs 1,134 crore, revenue up 42%

The National Payments Corporation of India (NPCI), which operates India’s homegrown Unified Payments Interface (UPI), has reported a 37% rise in net profit at Rs 1,134 crore for the fiscal year 2024.

Revenue generation: The Mumbai-based retail payments network generates revenue primarily by operating services such as UPI, IMPS (Immediate Payment Service), AePS (Aadhaar Enabled Payment System), BBPS (Bharat Bill Payment System), and NCMC (National Common Mobility Card). It receives a percentage of the transaction value processed by its partner banks.

FY24 financials:

- Income from payment services rose 37% to Rs 2,693 crore

- Other operating income more than doubled to Rs 118 crore

- Total revenue jumped 42% to Rs 3,278 crore on a consolidated basis

- Marketing expenses surged over 75% on year to Rs 781 crore

Recap: Last month, NPCI spun off its UPI-based payment application, Bharat Interface for Money (BHIM), as a separate subsidiary. It is also planning to spin off its card network RuPay and the lending feature Credit on UPI to better focus on its product portfolio.

Also Read | ETtech In-depth | Bhim promised the moon but failed to deliver. Can NPCI turn it around?

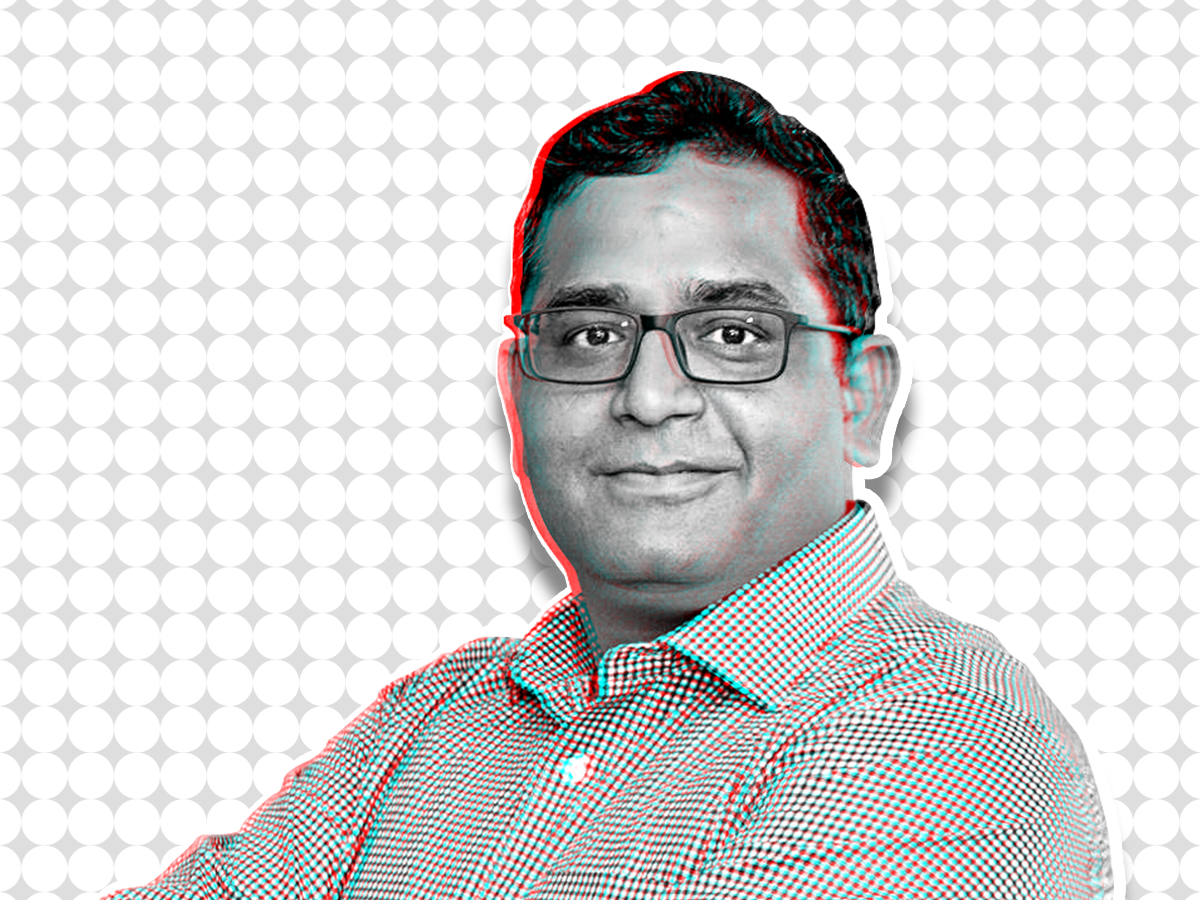

Paytm aims for profitability with ‘compliance-first’ approach: Vijay Shekhar Sharma

Vijay Shekhar Sharma, founder, Paytm

Paytm will try to achieve profitability soon, founder Vijay Shekhar Sharma said at the company’s 24th annual general meeting. He, however, did not commit to a timeline.

Compliance in focus: Sharma said the digital payments company will adhere to regulatory guidelines strictly, and adopt a ‘compliance-first approach’.

Paytm Payments Bank lost its ability to offer basic banking services to its customers on March 15, after the Reserve Bank of India highlighted major regulatory lapses in its compliance process earlier this year.

PA licence: Sharma also said the company would like to apply for the payment aggregator licence, now that it has received requisite approvals from the Union government. The Centre cleared the foreign direct investment (FDI) into its merchant payments business in July, thereby making it eligible to apply for a PA licence.

Quote unquote: Madhur Deora, chief financial officer, Paytm, said the company has cash reserves of Rs 8,500 crore, and it would focus on building products and services for 500 million Indians, bringing them into mainstream financial services.

NCLAT adjourns Byju’s case hearing to Oct 1

Byju Raveendran, founder, Byju’s

The Chennai bench of the National Company Law Appellate Tribunal (NCLAT) has adjourned the case involving Glas Trust Co, which represents a group of US lenders to troubled edtech firm Byju’s, and its parent company, Think & Learn, to October 1.

Background: The Supreme Court is also hearing an appeal by Glas Trust, opposing a Rs 158-crore settlement arrived at between the edtech firm and the BCCI, alleging that the money paid by Byju Raveendran’s brother Riju Ravindran was tainted.

Recap: On August 14, the Supreme Court revived the insolvency case against Byju’s, overturning a NCLAT decision that had quashed the bankruptcy proceedings and approved the settlement agreement with the BCCI.

On September 4, the Bengaluru bench of NCLAT deferred the matter between Glas Trust Co and the insolvency resolution professional (IRP) for the parent company, Think & Learn Pvt Ltd.

Auditor resigns: We reported on September 7 that Byju’s said its audit firm MSKA Associates, an affiliate of BDO International, has resigned. This is the second auditor to step down from the embattled firm since June 2023, when Deloitte had left citing governance concerns.

Mamaearth shares tumble 5% after Rs 1,763 crore stake sale via block deal

Varun Alagh and Ghazal Alagh, cofounders, Mamaearth

Shares of Honasa Consumer, the parent company of Mamaearth, fell 5% to the day’s low of Rs 495 on the NSE following the sale of a 10.9% equity stake worth Rs 1,763 crore through a block deal on Thursday.

Sellers listed: The transaction reportedly involved sellers such as Peak XV Partners, Redwood Trust, Sequoia Capital, Fireside Ventures, Stellaris Venture Partners India, and Sofina Ventures SA.

Initially, it was reported that the sellers would offload an 8% stake in the company, equivalent to 263 crore shares valued at Rs 1,261 crore. However, the deal size was later increased to a sale of 10.8%.

Financials:

- Consolidated net profit up 63% on year to Rs 40 crore for the April-June quarter of FY25

- Revenue for quarter was Rs 554 crore, up 19% on year

Zomato shares zoom 4% to fresh all-time high as UBS reaffirms ‘buy’ rating

Deepinder Goyal, founder, Zomato

Zomato’s shares rose 4% on Thursday, reaching a new all-time high of Rs 283.60, after global brokerage UBS maintained a ‘buy’ rating with a target price of Rs 320, driven by a positive growth outlook.

Growth: UBS noted that the industry volumes are growing at about 2.5% on a month-on-month basis in August this year, which has been adjusted for the number of days. The global brokerage firm estimates Zomato’s Q2FY25 GMV growth at 7% quarter-on-quarter.

Acquisitions: The food delivery major entered into a deal with Paytm to acquire its events and movies ticketing business which was recently completed. Following this, global brokerage firms such as Jefferies and JP Morgan have also turned positive on the stock.

Also Read | BookMyShow’s business story gets Zomato’s Paytm plot twist

Today’s ETtech Top 5 newsletter was curated by Riya Roy Chowdhury in Bengaluru and Megha Mishra in Mumbai.